Quiz: Find Your Fit

Is a Pooled Income Fund Right for You?

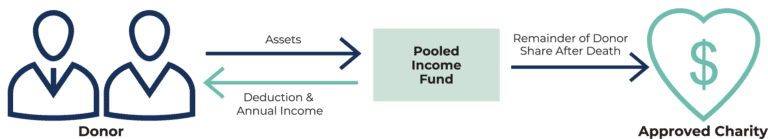

A pooled income fund may be the right tool for donors who have a desire to benefit charity, but may only have a modest investment to contribute. Donors to a pooled income fund must recognize that there can be fluctuations in the net income of the fund.

Our Find Your Fit Questionnaire can help you discover if a pooled income fund is right for you. Click the button below to fill out the questionnaire, or keep reading for more helpful information.