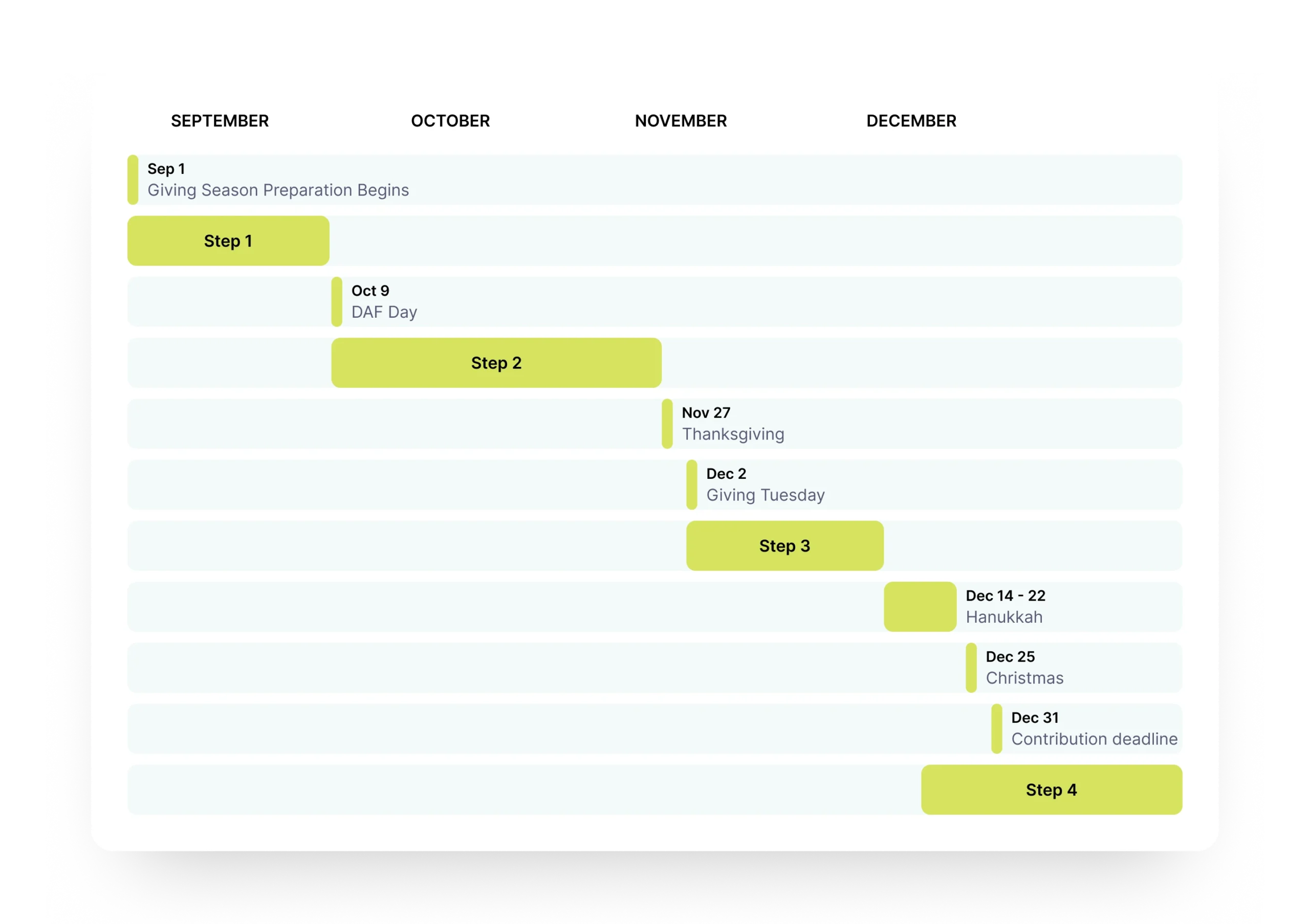

Your Donor-Advised Fund Roadmap for Giving Season

A clear path for advisors to guide clients, especially those without a DAF, through year-end giving

Step 1

Take Inventory & Plan Your Conversations

Identify clients seeking to reduce taxable income, optimize charitable giving, manage high income or portfolio rebalancing, plan wealth transfers, or face lower deduction limits in 2026 under OBBBA.

Plan ahead of OBBBA deduction changes that go into effect Jan. 1, 2026

Step 2

Engage Existing DAF Clients

Confirm client DAF contribution and offer year-end support if pending.

Donating appreciated stock can maximize tax benefits before Dec. 31.

Step 3

Create Accounts for New DAF Clients

Encourage clients without a DAF to open as early as possible for a seamless year-end.

DAFs are popular for their simplicity and flexibility. Most advised clients could benefit—don’t assume disinterest without asking.

Step 4

Execute Your Client’s Contribution Plan

Check in with your client after Thanksgiving. Ensure alignment on asset types, amounts and donation dates. Confirm once you’ve completed their gift.

Contributions made by Dec. 31 count for the 2025 tax year if they leave your control in 2025, even if not posted by year-end.

Simplify giving season

Our experts are ready to make this giving season your easiest one yet.