Events

We’d love to connect with you!

Use this page to see where you can find us in action, from industry conferences to QuickHit webinars that give you the information you need in the time that you have (15 mins).

We’ve indicated where we are hosting, speaking, or sponsoring as well so you can find our booth or attend our sessions. Use the links below to register for these events and book a call with a Ren rep who will be in attendance.

Events We’re Attending

If you’re attending one of the events below, schedule a time to meet with one of our Ren team members. We would love to meet you.

IWI Experience

Experience is the Investments & Wealth Institute’s flagship wealth management conference, bringing together top advisors and industry thought leaders for high-impact education and networking. Attendees gain practical insights, earn continuing education credits, and build connections to elevate their practices.

Women in Independent Wealth West

The Women in Independent Wealth Summit brings together women leaders in independent wealth management for connection, insight, and inspiration. Attendees engage in thoughtful conversations, peer learning, and meaningful networking.

On-Demand Webinars

Catch up on practical tools and big ideas that help you serve clients and stay ahead of trends.

Advisors working with HNW clients increasingly encounter complex or illiquid assets, often before it’s clear how to introduce charitable planning with confidence. This live case lab walks through one client scenario to show how charitable planning decisions actually unfold when assets, timing, and uncertainty are in play.

How to Confidently Initiate Charitable Conversations with High-Net-Worth Clients

Charitable planning is often one of the most impactful conversations advisors can have with high-net-worth clients, yet it’s also one of the hardest to initiate. In this practical session, a Ren Charitable Strategist will walk through clear, natural language advisors use to open charitable conversations with confidence, without overcomplicating the plan or feeling pressure to have all the answers.

DAFs, Deadlines, and Deductions: How Advisors Can Maximize Year-End Opportunities

The final months of the year are packed with opportunity and urgency. As clients review their tax positions and charitable goals, advisors have a powerful window to spark strategic giving conversations that make a difference right now and, in the years ahead.

3 year-end conversations every advisor should have now

Year-end giving season is here, and the clock is ticking. Join Carla Comstock for a fast, practical session on the three client conversations to spark action before year-end deadlines hit.

Using DAFs to manage concentrated positions

Have a client with too much in one stock? In just 15 minutes, you’ll learn how to turn that concentrated position into a smarter, tax-savvy year-end move using a donor-advised fund (DAF). No selling required, just an in-kind donation before December 31.

OBBBA strategies to act on now for your clients

The One Big Beautiful Bill Act (OBBBA) gives your HNW clients a rare window to act—higher gifting limits, a 2025 sweet spot for deductions, and a looming 2026 charitable “floor” make now the moment to plan.

Philanthropic QuickHit: Using a DAF and CRT to reduce taxes and create an income stream

Pair a charitable remainder trust with a donor-advised fund, and you’ve got a strategy that reduces taxes, keeps your client’s income flowing, and turns a liquidity event into long-term impact. In just 15 minutes, we’ll break down how this combo works, when to use it, how to structure it, and what kind of client it’s perfect for. Whether your client is about to sell a business or offload a chunk of stock, this is how you help them win on both the financial and philanthropic fronts.

How to advise charitable giving when markets are in flux

Volatile markets are your moment to lead. In this 15-minute QuickHit, Cole Davidson and Kaycee Butler break down how DAFs can help you deliver clarity, continuity, and confidence when clients need it most.

Business exits: Guiding owners through smart exits

You don’t need to know everything about gifting business shares to a DAF. You just need to know when to ask the right question and who to call when it gets complex.

Business exits: How DAFs helps clients save big

Your client is about to sell their business and capital gains are circling. But here’s the play: If they gift shares to a donor-advised fund before the deal closes, they can avoid capital gains tax on those shares and make a major charitable impact.

Business exits: Deepen client relationships

When your client is preparing to sell their business, it’s not just about the numbers. It’s personal. It’s emotional. Most advisors miss the chance to go deeper because they don’t ask the legacy question. But you can. And when you do, you’re not just a financial expert, you’re a long-term partner.

Recoverable grants with Ren and CapShift

In this 15-minute Philanthropy QuickHit, explore how recoverable grants and impact investing through donor-advised funds (DAFs) are reshaping the future of philanthropy, with CapShift joining us as a key partner to share their expertise.

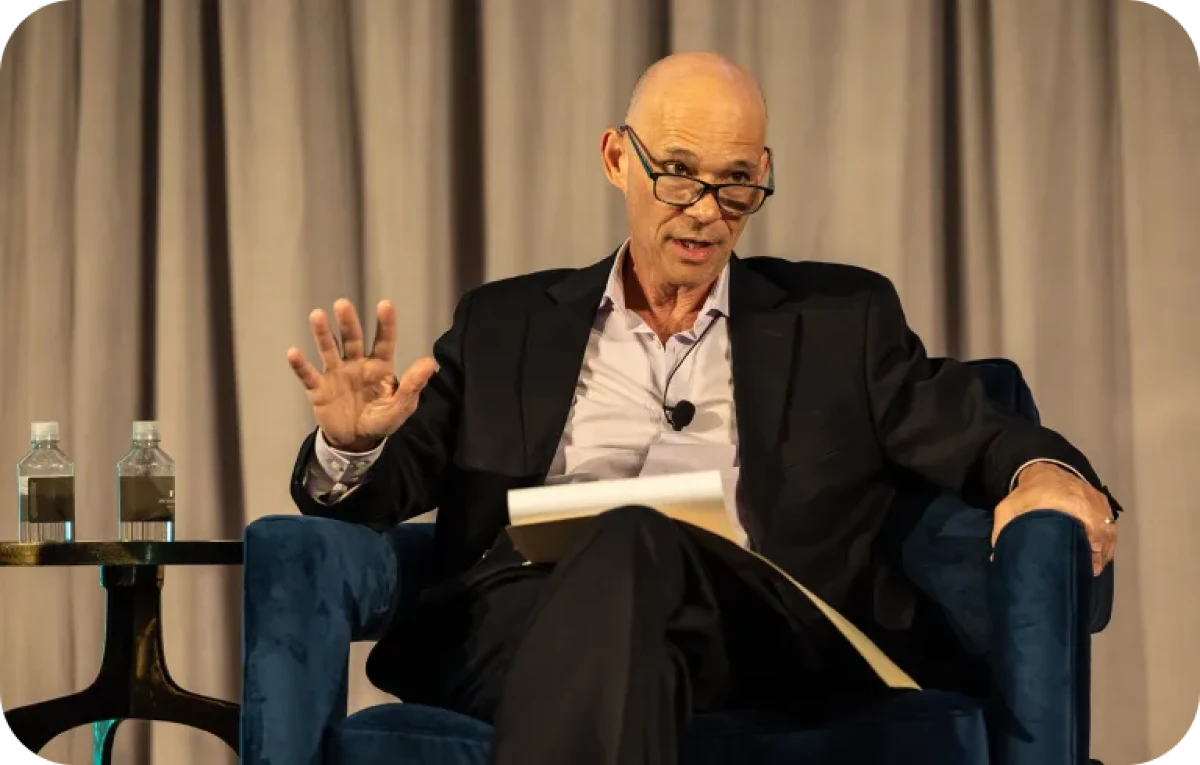

Events Gallery

A collection of our favorite moments from Ren’s annual DAF Giving Summit.