Year-end toolkit: Help clients donate stock, reduce taxes, and give smarter

Unlock year-end giving opportunities with this concentrated stock toolkit This ready-to-use toolkit helps financial advisors talk to clients about donating appreciated stock to a donor-advised fund (DAF) before December 31. Whether you’re guiding year-end tax planning, rebalancing conversations, or legacy giving, these resources make it easy to identify opportunities, explain the strategy, and take action—before the deadline.

Ren Marketing

REN INC

1. Advisor Quick Guide

How to use it: A quick-reference summary designed to help advisors understand the key talking points, benefits, and strategic value of using a DAF to manage concentrated stock positions. Ideal for internal prep before client meetings or calls.

2. Client Explainer

How to use it: A simple, client-facing PDF advisors can share via email or use as a leave-behind. This one-pager introduces the value of donating appreciated stock to a DAF in clear, accessible language—perfect for sparking curiosity before a deeper planning conversation.

3. Conversation Starter Script

How to use it: A short, print-friendly or mobile-friendly guide advisors can use during client meetings or review sessions. Packed with confident, client-tested phrasing and timing cues, this is especially helpful for newer advisors or those unfamiliar with charitable giving strategies.

4. Teaser Email Template (Advisor → Client)

How to use it: A copy-paste email that advisors can send to clients who may be holding appreciated assets. This version includes a clear year-end spin to spark interest in charitable giving strategies using a DAF—perfect for CRM or Outlook outreach.

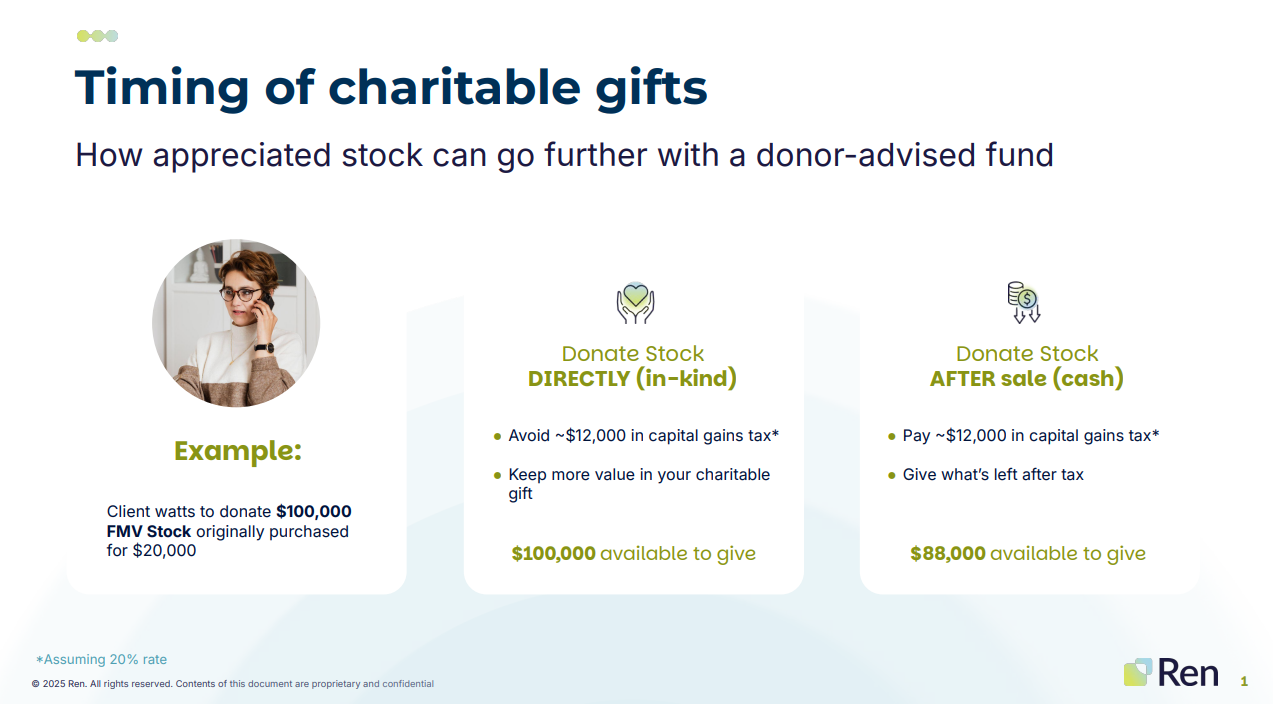

5. Year-End Timing Visual (Slide Format)

How to use it: This clean, advisor-facing slide shows the ideal timeline for completing in-kind stock donations before year-end. Use it during client meetings, year-end planning reviews, or internal strategy sessions to reinforce urgency and guide next steps. Visualizes how timing affects tax impact and charitable flexibility.

Ren Marketing

REN INC

Get an edge on charitable giving.

Sign up for our newsletter