Who Is a White-Label Donor-Advised Fund For?

A white-label (private-label) donor-advised fund is a great option for organizations that wish to offer charitable giving tools for current and future donors, but lack the infrastructure or expertise in how to administer it.

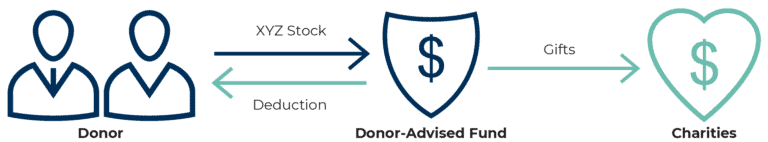

Contributing to donor-advised funds is a popular charitable giving option for individuals who are subject to paying capital gains taxes on appreciated assets, whose estate is subject to taxes, who want to benefit charity, and who want to involve their family in philanthropy.