Guiding you through charitable giving

Discover which charitable giving option is right for you.

Ren provides the knowledge, support, management, and services you need to create a lasting legacy for your family and your community while reducing your tax burden.

We can set up and manage many types of charitable giving vehicles for new donors or take over management of existing vehicles to ease the burdens of generosity.

Ren’s most popular service for individuals is the set up and management of donor-advised funds, which allow for the transfer of assets to a public charity for the purpose of charitable giving.

A donor-advised fund is similar to a health savings account in that money is deposited into an account that can grow in value. But instead of using the dollars to pay for health expenses, funds deposited into a donor-advised fund are granted out to charities. Donors receive an immediate charitable deduction once they make their donation into the donor-advised fund account, then at their leisure, they recommend the charities they want to receive gifts.

Donor-advised funds are the nation’s fastest growing giving vehicle. They are ideal for charitably minded individuals who face capital gains taxes on appreciated assets or estate taxes, and who may want to involve their family in philanthropy.

Donor-advised funds help charitably minded individuals reduce estate taxes and capital gains taxes on appreciated assets.

A donor can recommend a wide range of investment options to their financial advisor for the assets of their donor-advised fund account.

Donor-advised funds are a wonderful tool to establish a legacy of giving. Heirs and loved ones can be part of the process of distributing grants to charity and can even be named successor grant advisors so the donor-advised fund can last for generations.

A charitable gift annuity is a contract between a charity and a donor in which the donor irrevocably transfers assets to the charity in exchange for the payment of a fixed sum to the donor and/or beneficiaries for the lifetime(s) of up to two beneficiaries.

This is an effective solution for donors with appreciated assets they would like to move outside of their taxable holdings.

A charitable lead trust is an irrevocable agreement in which a donor transfers assets to a trust that creates an income or lead interest for a charity.

A charitable lead trust is a powerful charitable planning tool used to generate charitable deductions for income, gift, or estate taxes.

A charitable remainder trust is a tax-exempt trust that can liquidate an asset to create two interests: income interest and remainder interest.

This approach is especially beneficial for charitably minded individuals who are subject to paying capital gains taxes on appreciated assets, whose estate is subject to estate taxes, and who need ongoing income.

A pooled income fund offers a great opportunity for individuals with philanthropic ambitions but modest amounts to contribute.

An irrevocable trust maintained by a public charity, a pooled income fund combines gifts from a number of donors, investing them together to generate funds for distribution to charitable organizations.

A pooled special needs trust generates funds for individuals with disabilities. Assets contributed by multiple donors are combined and invested together, with funds being spent on individual beneficiaries in proportion to their share of the total amount.

A private foundation is established as a tax-exempt entity that can receive contributions as a charitable organization under Section 501(c)(3) of the Internal Revenue Code.

A private foundation works well for donors who wish to receive a current income tax deduction, and who may wish to use the foundation as the charitable recipient of distributions from a charitable remainder trust or charitable lead trust.

Discover which charitable giving option is right for you.

The Twains avoid capital gains and endow charitable giving.

The Stacks use a donor-advised fund to bunch charitable giving.

With more than 30 years of experience in charitable gift services, we support charitable gift portfolios for over 140 institutions – including large and small nonprofit organizations, financial firms, universities, and community foundations – and provide the expertise, standards, and technology these organizations need to attract new donors and clients while keeping current ones happy and engaged.

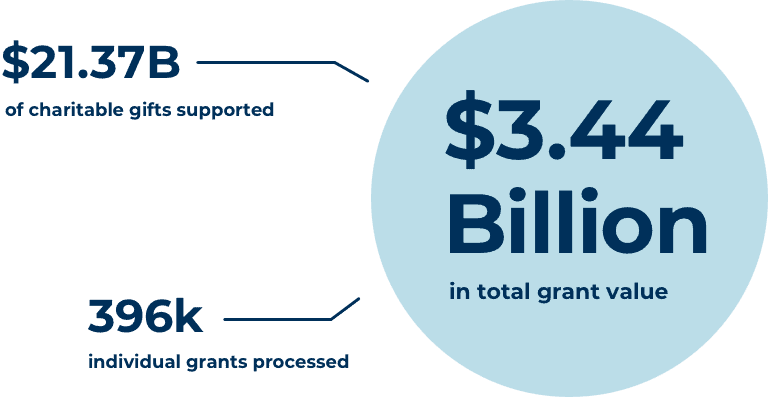

Ren by the numbers.

If you’d like to continue to explore charitable gift options before you contact us, visit our Education Center. You will find information about giving vehicles, helpful calculators, important FAQs, and more.

Let’s start a charitable conversation today.

8888 Keystone Crossing, Suite 1200

Indianapolis, IN 46240

(317) 757-3453

© 2025 Ren. All rights reserved | Privacy Policy | Terms of Service | Giving Sustainably with Ren