Who is a donor-advised fund for?

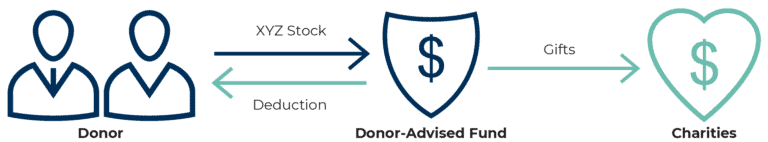

A donor-advised fund can be a great solution for anyone who is subject to paying capital gains taxes on appreciated assets, whose estate is subject to taxes, who wants to benefit charity, and who wants to involve their family in philanthropy.

Our questionnaire can help you discover if a donor-advised fund is right for you. Click the button below to fill out the questionnaire, or keep reading for more helpful information.