Who Is a Candidate for a Charitable Gift Annuity?

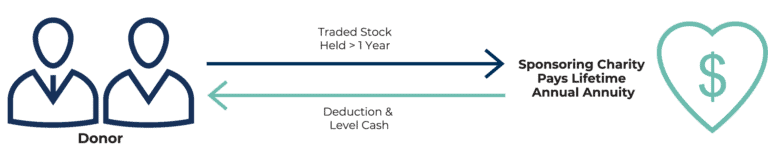

A charitable gift annuity is ideal for donors who have appreciated assets which would generate a large capital gain liability to the donor if sold outright. This immediate capital gain recognition is avoided when donors contribute these assets to a charity via a charitable gift annuity. Donors seeking a steady income stream for themselves or their heirs, and an income tax charitable deduction for the year in which the charitable gift annuity is established, are also viable candidates.

Our questionnaire can help you decide if a charitable gift annuity is right for you. Click the button below to fill out the questionnaire, or keep reading for more helpful information.