8910 Purdue Road, Suite 500

Indianapolis, IN 46268

(317) 757-3453

We want you to succeed at your philanthropic endeavors, and we have the tools, knowledge, and resources to help you get there. We give financial institutions and charitable organizations the support they need to develop and grow giving programs that thrive. With modern approaches and tailored solutions, we serve a variety of clients:

Differentiate your brand and increase your institution’s clients, assets, and impact with programs that make it easy to integrate charitable giving into your services.

Make the most of your client’s charitable giving with access to industry experts, tools, and our education center.

Efficiently engage a wider segment of current and prospective donors while streamlining fundraising, grant management, and settlement.

Use our expertise, standards, and technology to attract new donors and clients while keeping your current ones happy and engaged. With more than 30 years of experience in charitable gift services, Ren supports charitable gift portfolios for over 140 institutions – including large and small nonprofit organizations, universities, community foundations, and financial firms.

Democratizing philanthropy with a modern platform for charitable giving.

The need and appetite for philanthropy has never been greater. Nonetheless, the level of charitable giving has remained at 2% of GDP for decades. Why? Because there’s simply too much friction in giving systems and services.

Ren fixes that.

We support charitable organizations, financial institutions, and individuals with technology and expertise that remove the friction from giving.

Through our acquisition of Pinkaloo, the addition of crypto-friendly contributions, and ongoing financial technology innovations, we are building on our three decades of experience to drive a revolution in the philanthropic marketplace. The result? Our customers and their clients can put their charitable ambitions into action more easily and efficiently to increase their impact and improve their communities and the world.

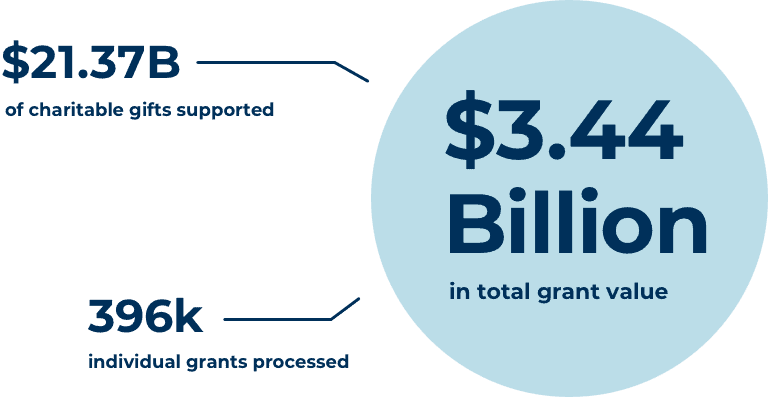

Ren by the numbers.

The Ren Education Center gives you access to information and tools that include explanations of gift types, giving illustrations, and calculators. Learn more below.

Learn more about charitable giving options, such as donor-advised funds or charitable trusts. Learn more

Take our Find Your Fit Questionnaire or use our securities donations calculator or gift calculator. Learn more

Learn about IRS rates and transferring trusts, and get answers to frequently asked questions. Learn more

When people think of family legacies, names like Carnegie, Ford, and Rockefeller spring to mind. These families were pioneers in business and innovation…

Let’s start a charitable conversation today.

8910 Purdue Road, Suite 500

Indianapolis, IN 46268

(317) 757-3453

© 2024 Ren. All rights reserved | Privacy Policy | Terms of Service